5+ Expected Move Calculator

Web The Expected Move is the amount that a stock is expected to move up or down from its current price as derived from current options prices. Using the calculator we can see that compared to OTM calls the ITM.

How To Find The Expected Move Of A Stock And How To Use It To Your Advantage When Trading Options Youtube

Web See expected moves for a given time frame and compare multiple symbols on the same chart.

. 2 2022 he said. All that means is looking at the last traded price picking the nearest strike and buying the call and the put both on the ask. Standard deviation is a statistical measure.

Taking the at the money front month straddle and multiplying by 085 is a simple way to calculate expected moves for binary events such as earnings reports. Good luck this week traders. Lets assume the current stock price is 200.

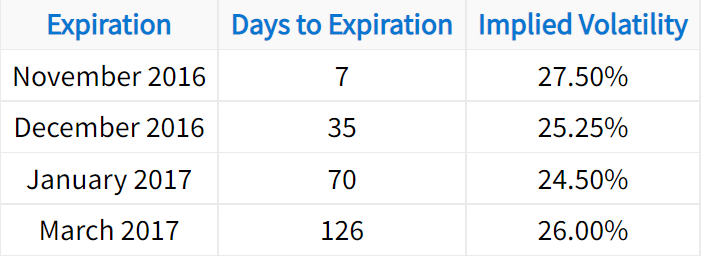

Httpsgeniusoptions-courseA stocks expected move represents that stocks one standard deviation expected price ra. The closest option strike is 4110. Web Expected move gives traders the chance to calculate an expected range of price movement for a stock in a certain timeframe.

Web With these inputs plugged into the option calculator we can see the ITM call option will see a smaller loss -1878 if the price of AAPL stays at the current level and less profit 4685 if the stock goes up to 160 after 30 days under a constant volatility environment. Knowing the Expected Move can provide useful insight into what the options market is predicting for a stock or ETF. 1825 strike call 353.

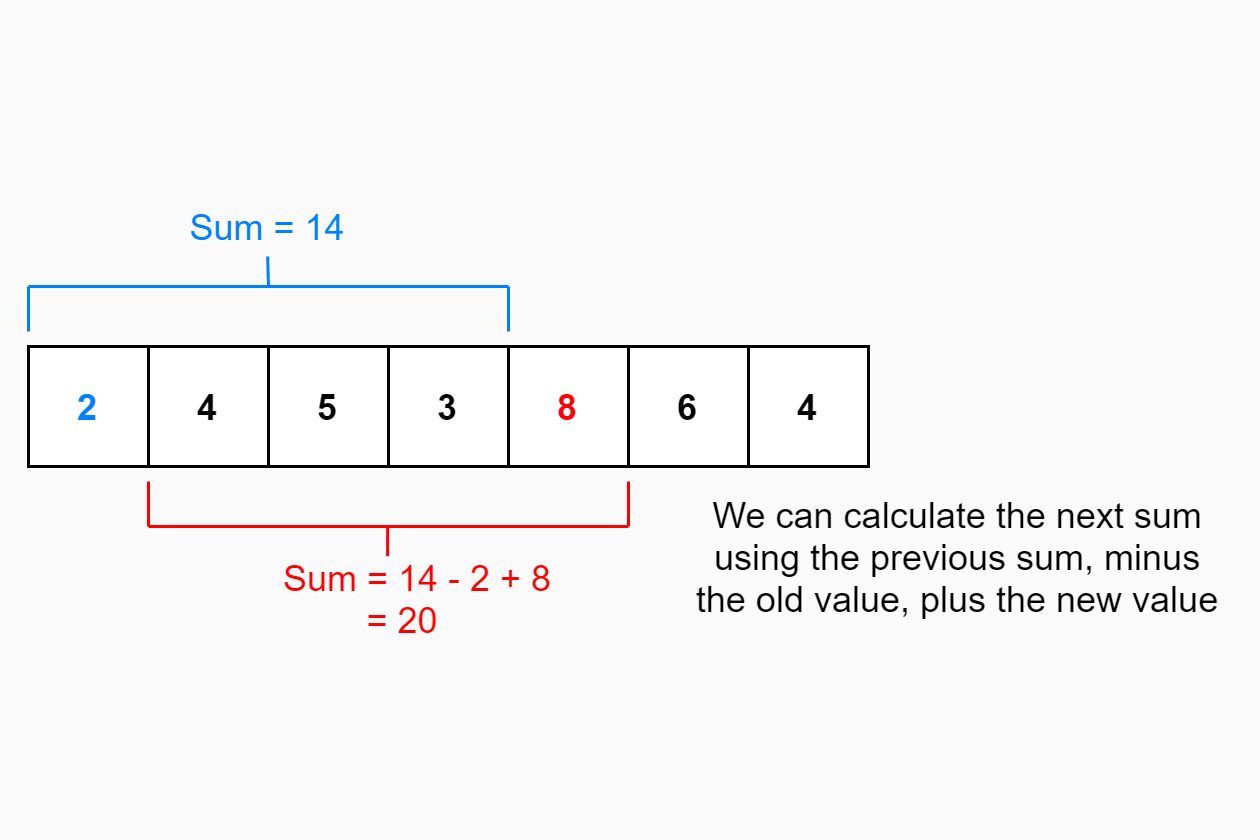

Generally this number given current market context has been a bit below the ToS calculation. First will be the pricing of the at the money straddle. It can serve as a quick way to see where real-money option traders are pricing the future of a stock.

Web The consumer price index averaged above 3 in the final three months of 2023 and the MBA and Fannie Mae expect it to fall below 3 in the first three months of 2024 and fall even lower through. The spreadsheet also gives us the PL expected range for 1 2 3 and 7 days on a given position. 175 strike put 302.

Web The expected move is the amount that options traders believe a stock price will move up or down. Between 1 April 2024 and 25 July 2024 there are 116 days. Using the above figures one can now calculate the markets expected move for AAPL through the January 2022 monthly options expiration which occurs on Jan.

Options AI incorporates intelligent software into its capabilities through its expected move calculator. More specifically it is the future range of a stocks price at one standard deviation. Web 1 At The Money Straddle.

Web Below is an expected move comparison via the Options AI calculator for the SPY QQQ AAPL and TSLA. Web A major winter snow storm is moving through the Chicago area with as much as a foot of accumulation in spots. 116 365 x.

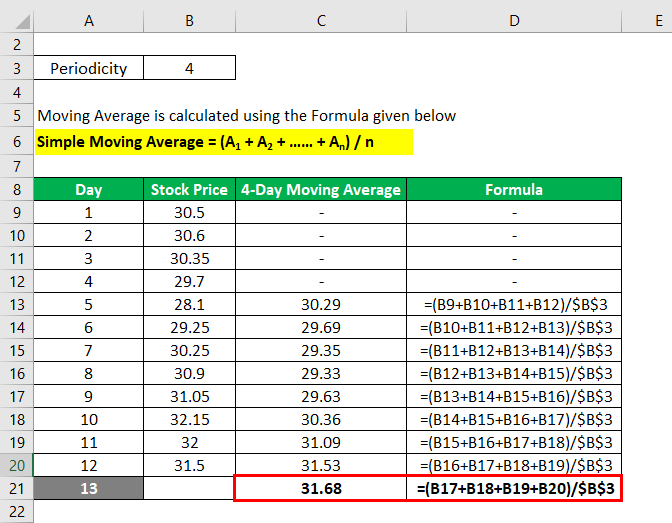

Some are seeing rain. SPY options are pricing about a 2 move for the next seven days and about 4 for the next month. Expected Move Stock Price x Implied Volatility x Days to Expiration 365.

Plug these values into the formula. The last time there this much snow was Feb. Expected Move Example stock at 200 The expected moves in this table suggest the following.

1775 strike put 393. Web Expected move calculator. Web 180 strike put 510.

The leave year runs from 1 April 2024 to 31 March 2025. Compare expected moves by adding more symbols. Search for the most active stocks last week or input your own.

Web One very quick way to determine how far the market is expecting the market to move by a given expiration is to add together the put and call premium of the option strike closest to the money. Expected move is one standard deviation of movement from any given close as priced in from the options market and there are. Web Hypergrowth Options Strategy Course.

Web FOXBOROUGH Mass. Web The Expected Move or Implied Move is the amount that a stock is expected to move up or down from its current price based on current options prices. Web The bigger the move the more uncertainty or implied volatility is priced into the options.

What is an Expected Move Chart. 185 strike call 265. As I write this the SP 500 index SPX sits at 410854.

Web If the stock makes a larger-than-expected move and the trade suffers a full loss it should not have more than a 1-3 effect on your portfolio. Search for any company to see expected moves via the options market. Web Days in employment during the leave year days in leave year x 100.

Web How To Calculate Expected Move for Stocks Trading Tutorials. Web The Expected Move represents the expected market movement range for an underlying for the future. Web The spreadsheet gives us the descriptiondollar per tick current price notional value and IV once we put in the symbol and amount of future contracts or shares.

The New England Patriots are parting ways with head coach Bill Belichick on Thursday after more than two decades and six Super Bowl titles which is the most won by a single. Note Apples expected move close to QQQ while Teslas is much greater. Options AI uses 925 of the value of the at-the-money ATM straddle for each expiration date to calculate the Expected Move s.

Use the calculator to compute the expected move which represents the estimated price range within which the underlying asset is expected to fluctuate. Web Apply the Formula. A series of powerful major weather systems are moving across the United States this week bringing extremely dangerous blizzard conditions to the center of the country.

QQQ options are pricing about a 25 move for the next seven days and. Web Using the formula and table from above lets calculate the expected move for each time period.

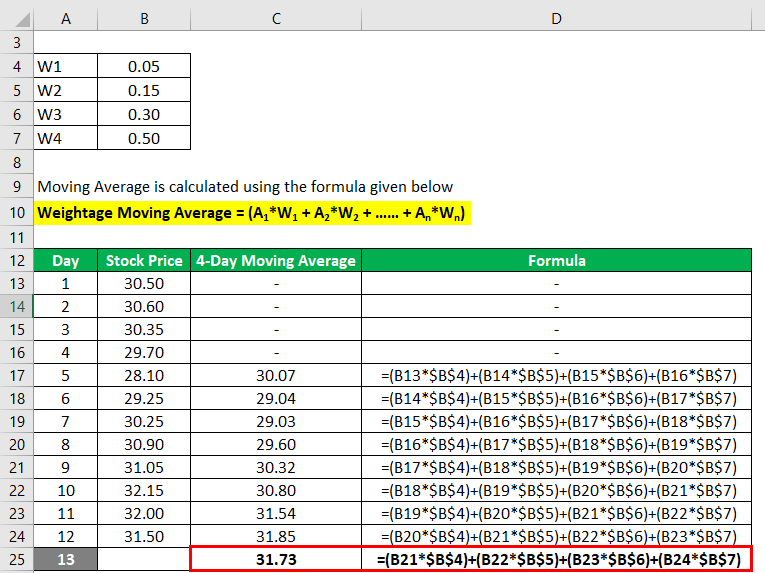

A Simple Moving Average Calculator

Expected Move In The Tastytrade Trading Platform

Moving Average Formula Calculator Examples With Excel Template

Calculate Moving Average Chandoo Org Learn Excel Power Bi Charting Online

Expected Stock Movement Calculate The Price Movement Of A Stock

Moving Average Formula Calculator Examples With Excel Template

:max_bytes(150000):strip_icc()/economic_indicator.aspfinal-15940724deaf40e09bf27f9e6b0bf832.jpg)

Economic Indicator Definition And How To Interpret

Expected Move Explained Options Trading Shortthestrike

Expected Move Explained Options Trading Projectfinance

Expected Move Explained Options Trading Projectfinance

Forecasting Archives Kellblog

Calculating Expected Move Using Option

How Much Do Movers Cost Try This Calculator Moving Apt

Calculating Expected Move Using Option

Calculating Expected Earnings Move Quick Tip Youtube

Options Expected Move Calculator Calculator Academy

Moving Cost Calculator 2024