Salary calculator plus overtime

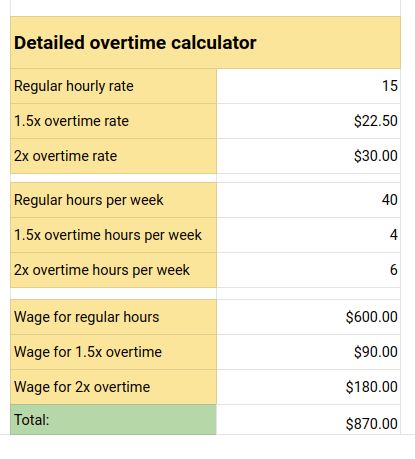

Heres a step-by-step guide to walk you through. Determine your multiplier m which you can see in the overtime policy of the company.

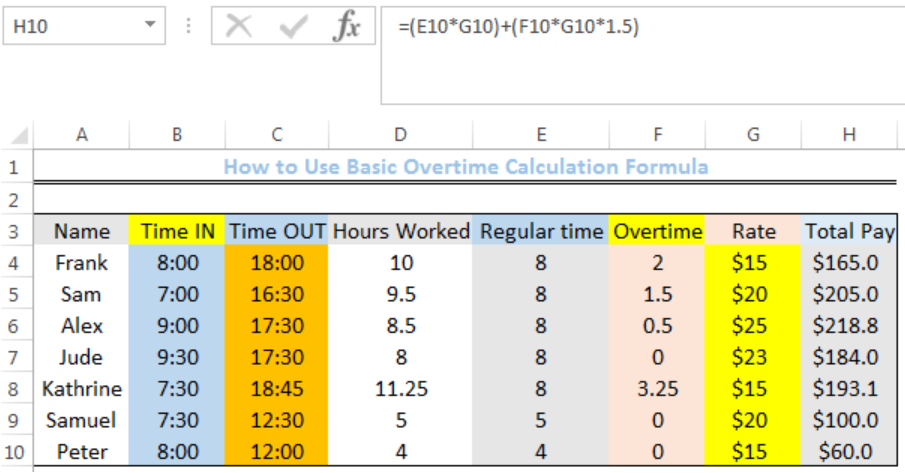

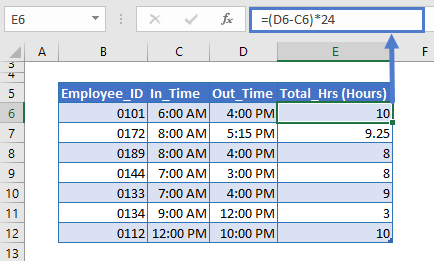

Calculate Overtime In Excel Google Sheets Automate Excel

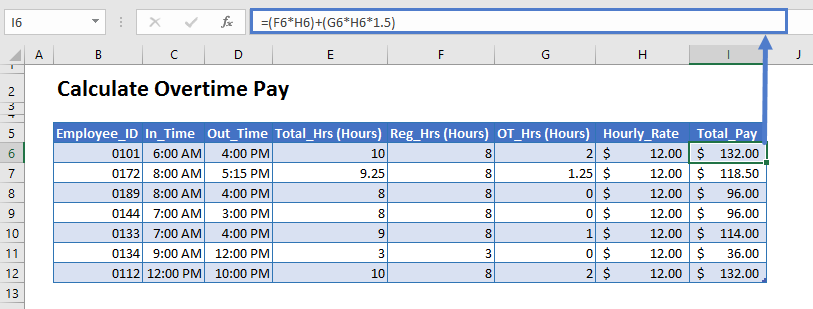

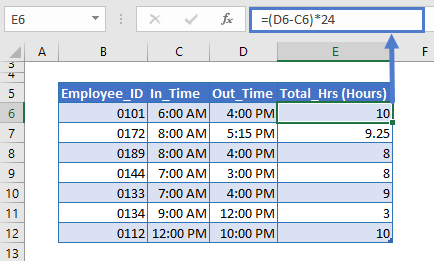

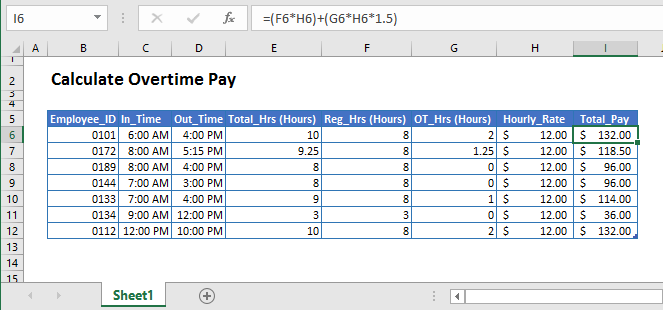

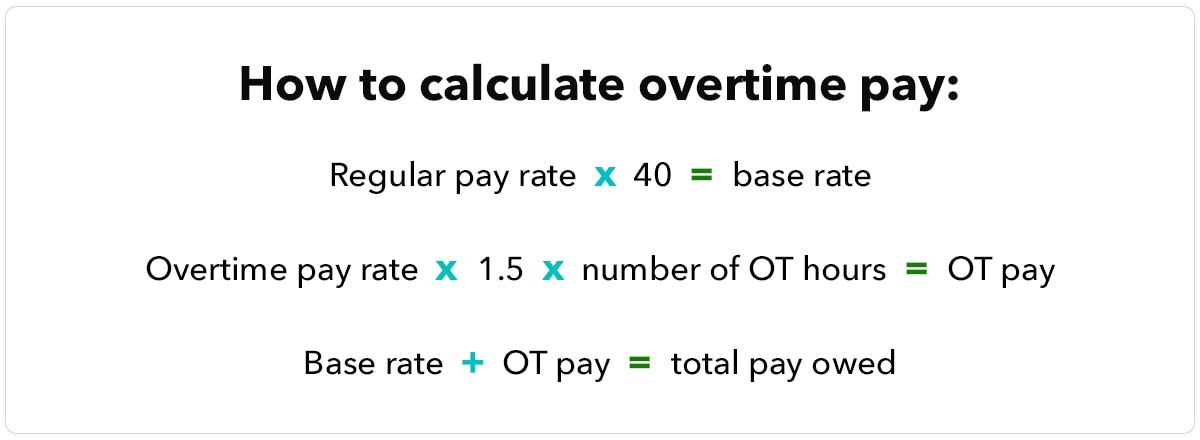

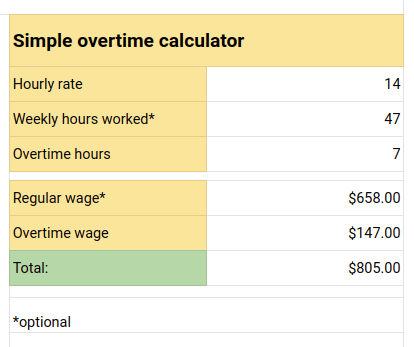

Calculate the overtime pay which is the number of overtime hours x the overtime hourly rate.

. The algorithm behind this hourly paycheck calculator applies the formulas explained below. All other pay frequency inputs are assumed to. For the cashier in our example at the hourly wage.

Overtime pay of 15 5 hours 15 OT rate 11250. Then enter the hours you expect to work and how much. Summary report for total hours and total pay.

Your employer is required by federal law Fair Labor Standards Act to pay time and a half wages regular hourly rate x 15 for all hours worked beyond 40 hours per week. 1500 per hour x 40 600 x 52 31200 a year. Calculate the gross amount of pay based on hours worked and rate of pay including overtime.

Of overtime hours Overtime rate per hour. Free online gross pay salary calculator plus. This salary calculator assumes the hourly and daily salary inputs to be unadjusted values.

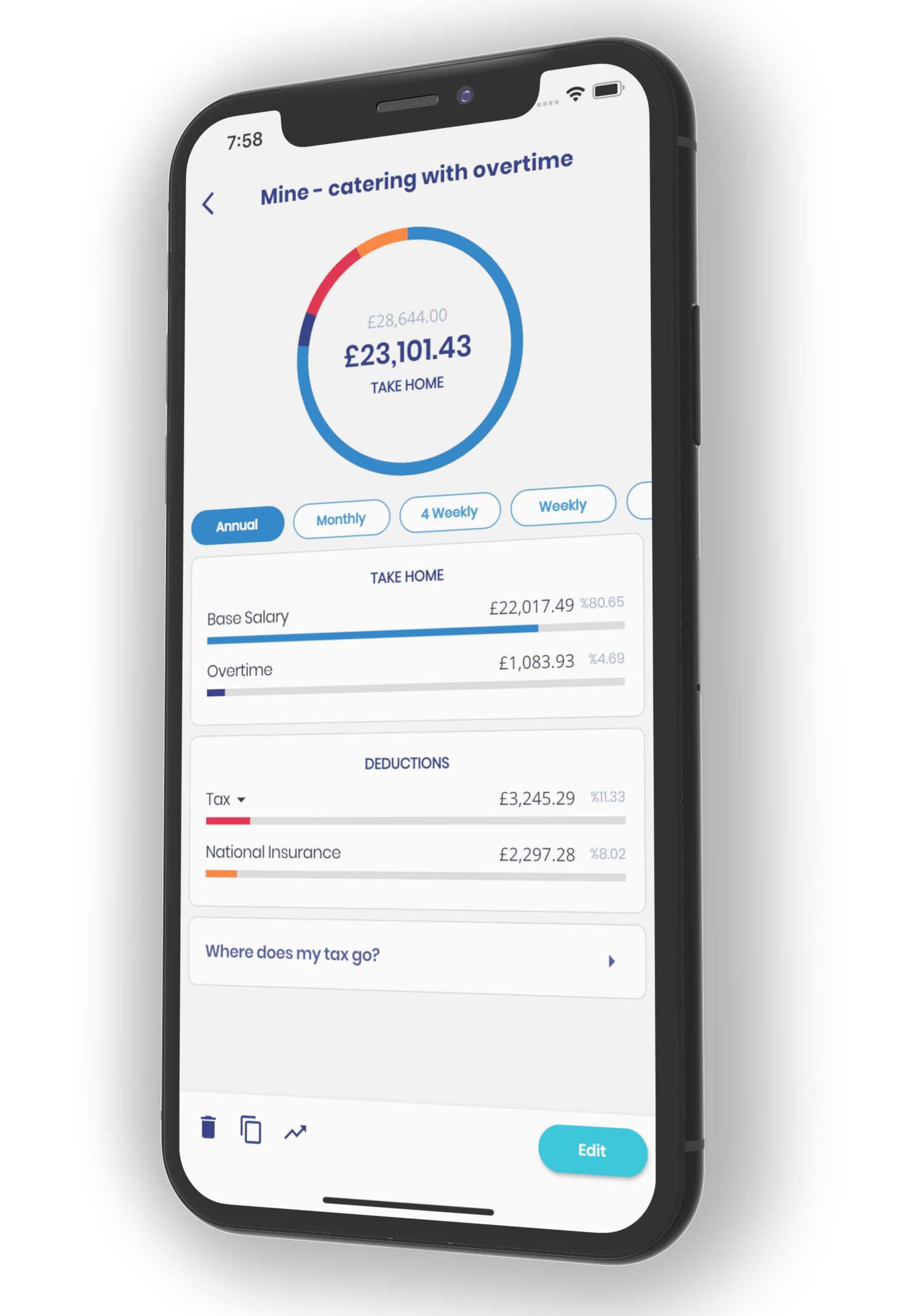

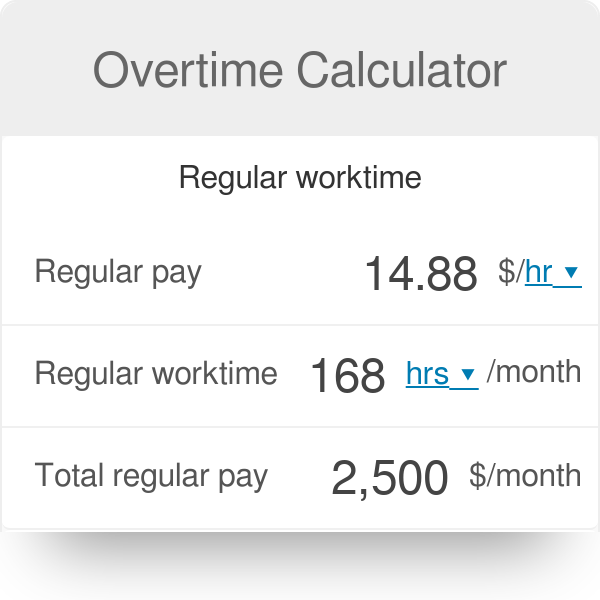

Overtime wages for a salary with fixed hours For this example lets assume your employee earns 500 per week. This overtime calculator figures your total overtime paycheck and the OT rate together with the regular pay by taking account of the number of hours worked. First enter your current payroll information and deductions.

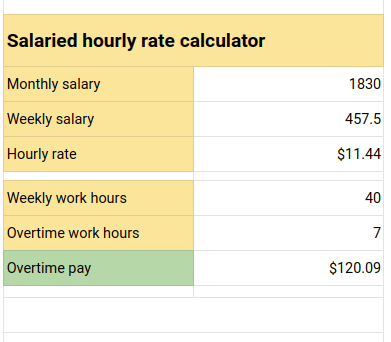

Unless exempt employees covered by the Act must receive overtime pay for hours worked over 40 in a workweek at a rate not less than time and one-half their regular rates of pay. Work out your overtime with our Overtime Calculator. If you are a monthly-rated employee covered under Part IV of the Employment Act use this calculator to find out your pay for working overtime.

Overtime pay calculation for nonexempt employees earning a salary A salary is intended to cover straight-time pay for a predetermined number of hours worked during the workweek. 48 x 15 720. Use this calculator to help you determine your paycheck for hourly wages.

This shows you the total pay you are due of regular time and overtime. Calculate the gross amount of pay based on hours worked and rate of pay including overtime. 4 x 40 160-hours.

For instance if the policy states a time-and-a-half rate this means that m 15. You can claim overtime if you are. Determine your multiplier m which.

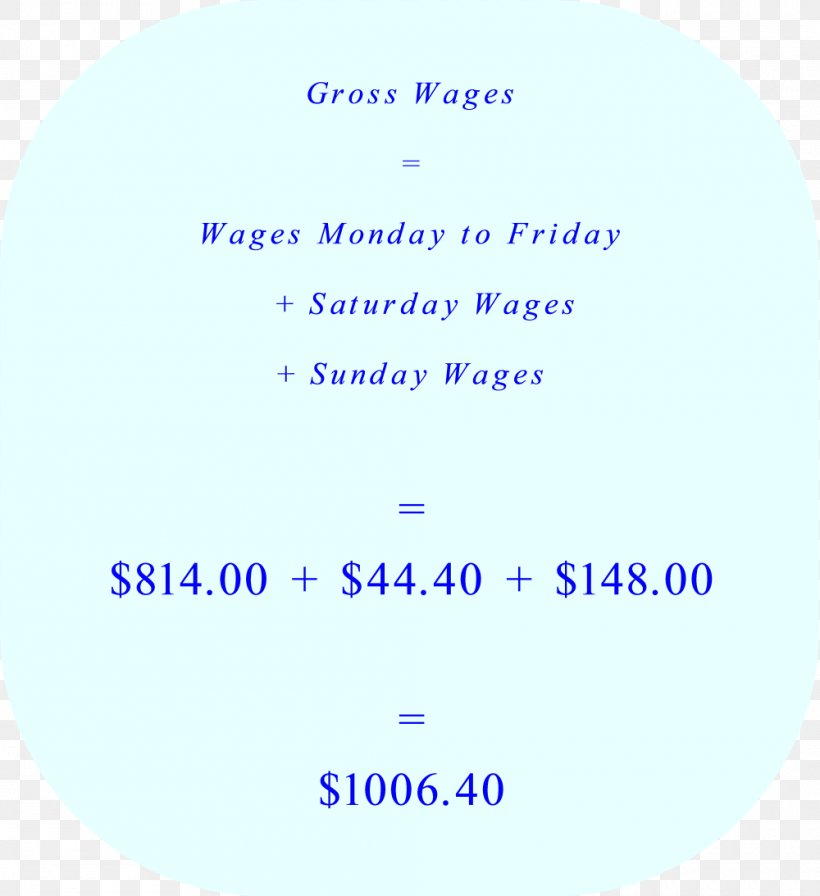

-Overtime gross pay No. 2 x 225 45. You expect that employee to work 36 hours a week.

Calculate the complete payment for the week. This free paycheck calculator makes it easy for you to calculate pay for all your workers including hourly wage earners and salaried employees. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

Free online gross pay salary calculator plus. So if your regular. Due to the nature of hourly wages the amount paid is variable.

-Total gross pay.

Calculate Overtime In Excel Google Sheets Automate Excel

Overtime Calculator Workest

Overtime Pay Calculators

Hourly To Salary What Is My Annual Income

Excel Formula Timesheet Overtime Calculation Formula Exceljet

Overtime Calculation Wage Mathematics Salary Png 1000x1093px Overtime Area Blue Brand Calculation Download Free

How To Calculate Overtime Pay For Hourly And Salaried Employees Article

Salary Calculator App

Excel Formula Basic Overtime Calculation Formula

Overtime Pay Calculators

Hourly To Salary Calculator

Top 6 Best Annual Salary Income Calculators 2017 Ranking Yearly Income Calculator To Calculate Annual Salary Advisoryhq

Hourly To Salary Calculator Convert Your Wages Indeed Com

Overtime Calculator To Calculate Time And A Half Rate And More

Overtime Pay Calculators

Overtime Calculator

Calculate Overtime In Excel Google Sheets Automate Excel